TL;DR: If you’re building an investment platform, you’re not just shipping features - you’re rebuilding investment infrastructure: eligibility logic, subscription state machines, payment reconciliation, ownership ledgers, document compliance, and audit trails. All of this is required. None of it is usually differentiating. You can spend 12–24 months building and maintaining this plumbing yourself - or you can use ONINO’s Shopify-style infrastructure for digital investment platforms and focus your engineering time on what actually matters: your product, your niche, and your distribution. This post breaks down what you’d have to build either way - and why many teams are better off not rebuilding the same infrastructure from scratch.

If you’re a CTO or founding engineer building an investment platform - whether that means crowdfunding, SPVs, private deals, or any kind of structured investment flow - you run into a specific kind of problem very quickly:

At first, the product seems straightforward: investors onboard, subscribe, wire money, receive ownership, and then you manage the lifecycle.

But after a few weeks of scoping, you realize you’re not building “a feature.”

You’re building a regulated system of record: eligibility logic, subscription workflows, payment reconciliation, ownership tracking, document compliance, audit trails - all the plumbing that private markets quietly depend on.

And that’s usually when the real question for a founding engineer shows up:

Are we building differentiated product - or rebuilding investment infrastructure?

This post is a practical breakdown of that trade-off.

The Core Reality: Investment Platforms Are Complex State Machines & Compliance Layers

Most teams start with something that looks simple:

- Investor signs up

- Investor subscribes

- Investor wires money

- Investor receives ownership

- Deal lifecycle continues

But in practice, each step is a regulated, stateful workflow with heavy operational edge cases.

If you build this in-house, you’re building multiple systems of record.

What You Actually Have to Build (Even for an “MVP”)

1. Investor Identity ≠ Just KYC

The naive approach: integrate a KYC provider.

The real requirements:

- Persistent investor profiles across deals

- Legal entities + beneficial ownership (KYB)

- Eligibility logic by jurisdiction

- Reusable verification + audit trail

At scale, onboarding is a sophisticated account system, not a form.

2. Eligibility Logic Becomes a Rule Engine

Once you operate in regulated markets, you implement complex, multidimensional branching logic like:

- Retail vs professional classification

- Appropriateness / suitability checks (MiFID II)

- Offering restrictions per country

- Document + disclosure requirements

- Different legally required disclaimers and warnings that need to be accepted

This is effectively a compliance state machine.

Most teams underestimate this by an order of magnitude.

3. Subscription Lifecycle Is Not a Single DB Insert

A subscription has states:

- Created

- Pending eligibility

- Signed

- Funded

- Allocated

- Closed

- Active

- Redeemed

So you need:

- Workflow orchestration

- Deterministic state transitions

- Idempotent processing (payments, allocations)

- Operator override paths

If you skip this, ops becomes manual immediately.

4. Payment Matching Is a Hidden Complexity Layer

Investors do not behave like Stripe checkouts.

They send:

- wrong references

- partial amounts

- late wires

- money from third-party accounts

So you need:

- Payment intent objects

- Bank reconciliation

- Allocation guards

- Real-time funding status

Every serious platform ends up building internal payments ops tooling.

5. Ownership Tracking Is an Event-Sourced Problem

Most teams start with:

user_id| deal_id| units

That breaks as soon as you support:

- multiple closings

- transfers

- redemptions

- secondary transactions

- corporate actions

Ownership becomes:

- event history

- reconstructable positions

- timestamp-consistent reporting

- audit-safe issuance

In other words: a ledger.

6. Document Compliance Is Its Own Subsystem

Each deal requires:

- subscription agreements

- disclosures

- risk warnings

- version-controlled acceptance

Meaning:

- documents are stateful

- they need to be personalized, in some cases even e-signed

- acceptance must be provable

- investors must always see correct versions

- audits depend on this layer

7. Reporting and Investor UX Is Operational Load Reduction

If investors can’t self-serve:

- positions

- documents

- distributions

- deal status

your ops team becomes an inbox.

Dashboards are not cosmetic - they are support deflection.

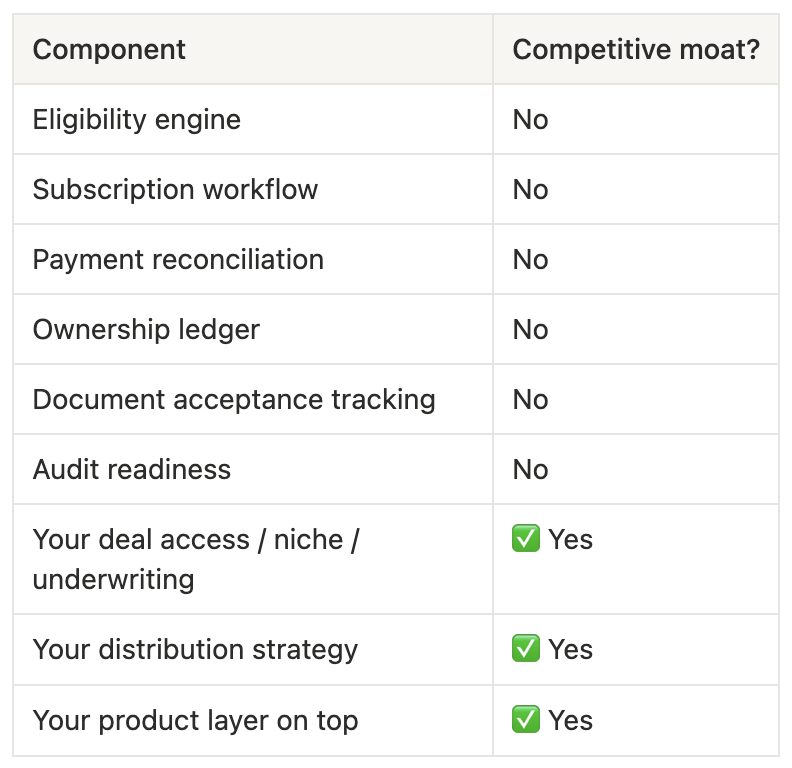

The CTO Question: Is Any of This Differentiation?

Ask honestly: does you product stand out because of the underlying technology, or your business and distribution strategy?

Most companies don’t win because they built better subscription state transitions.

They win because they control deal flow, distribution, or a niche asset vertical.

Build vs. Infrastructure: Practical Trade-Off

Build In-House

Makes sense if:

- Investment infrastructure is your core product

- You have a large team early

- You want full regulatory ownership

Costs:

- 12–24 months of platform engineering

- Continuous complex compliance maintenance

- Audit liability becomes internal

- Significant opportunity cost through the wait for the technology blocking your business to take off

Use Infrastructure (e.g. ONINO)

Best when:

- You want to launch investment products quickly

- You expect repeated SPVs / deals

- You don’t want to rebuild cap tables, workflows, and compliance plumbing

- Your differentiation is above the infrastructure layer

ONINO provides the core building blocks out of the box:

- Deal/SPV templates

- Investor portal + reusable onboarding

- Ownership + lifecycle tracking

- Document + audit layer

- Payment/subscription workflows

Think: Shopify-style infrastructure for private market investments.

So, what should I do?

Most teams don’t struggle with building investment platforms because they can’t write code.

They struggle because the scope expands quietly: what starts as “investors subscribe into a deal” turns into eligibility logic, subscription state machines, payment reconciliation, ownership ledgers, document compliance, audit trails, reporting - the infrastructure private markets require by default.

If you’re early in this build, it’s worth asking:

Is this really where you want your founding engineers spending the next 12–24 months?

Or would you rather focus on what actually differentiates your platform - distribution, deal access, underwriting, and product UX?

That’s exactly where ONINO fits.

ONINO is a Shopify-style infrastructure stack for digital investment platforms, giving you the core issuance and lifecycle building blocks out of the box - so you can spin up structured investment flows without rebuilding the plumbing from scratch.

Building an investment platform is absolutely possible - the real question is whether you want to spend your time building the plumbing, or building the business on top of it.

If you're currently architecting any of the systems discussed here, feel free to talk directly to our CTO Kai. We’re happy to compare approaches, share reference architectures, and help you sanity-check what “build vs. infrastructure” looks like in practice. Just drop a message to kai@onino.io!

.png)